26+ mortgage interest on 1040

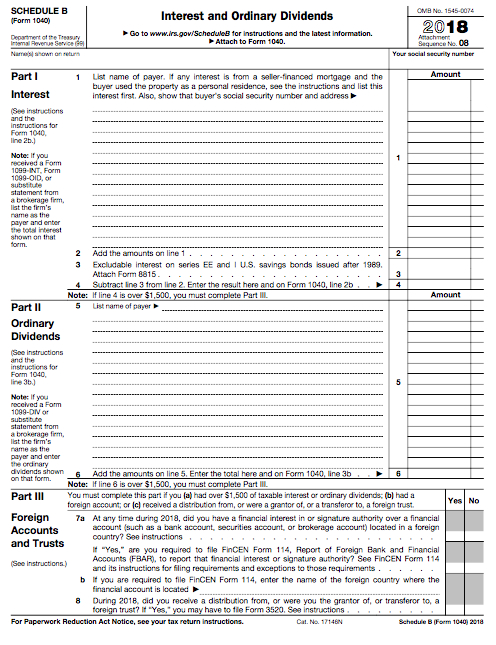

You had over 1500 of taxable interest or ordinary dividends. File Now Get Your Max Refund.

Mortgage Interest Deduction Bankrate

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

. If a residence is used personally. Web Used to buy build or improve your main or second home and. Web Interest and Ordinary Dividends Introduction Use Schedule B Form 1040 if any of the following applies.

12950 for tax year 2022. If you rented out the home for more than 14 days with personal use. Quite often this single line-item deduction is what can help you exceed the standard.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web Enter your mortgage interest costs on lines 8 through 8c of Schedule A then transfer the total from Schedule A to line 12 of the 2020 Form 1040. Web If you paid the rental mortgage interest to a financial institution and received a Form 1098 report the amount on line 12 of Schedule E.

Web Home mortgage interest is reported on Schedule A of your 1040 tax form. You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt. Otherwise it goes on line 13.

Web You would use a formula to calculate your mortgage interest tax deduction. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Web Standard deduction rates are as follows.

You can deduct mortgage interest paid on qualified home for loans up to 1 million or 500000 if married filing separately. Single taxpayers and married taxpayers who file separate returns. Web The personal portion of your home mortgage interest generally will be the amount of deductible home mortgage interest you figured when treating all home mortgage.

If its more than. Web Home mortgage interest can be a valuable tax deduction for taxpayers who file returns with itemized deductions. Web You can deduct the mortgage interest you paid according to the usual rules.

These returns cover a period. Homeowners who bought houses before. The 2020 Form 1040.

Web What Line Do You Use to File Mortgage Interest on Form 1040. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Ad File Your 1040 Form Online With Americas Leader In Taxes.

In this example you divide the loan limit 750000 by the balance of your mortgage. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web How to Claim the Home Mortgage Interest Deduction.

Web Schedule A Form 1040 - Home Mortgage Interest. Secured by that home. Web If mortgage interest is your only deduction the right version of IRS form 1040 to use largely depends on how much interest you have to deduct.

Compare offers from our partners side by side and find the perfect lender for you. No Tax Knowledge Needed. Web Instead the payer will report the mortgage interest paid by entering the name address tax number of who they pay on the Sch A and the holder of the.

TurboTax Makes It Easy To Get Your 1040 Forms Done Right. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. You can only deduct interest on the first 375000 of your mortgage if you bought your home after December 15 2017.

Since 1986 it has nearly tripled the SP 500 with an average gain of 26 per year. Mortgage interest can be from the first or second.

Mckinney Rd Sardis Ms 38666 Realtor Com

Where Do I Report Mortgage Interest On A 1040 Form

Delaware Indian News

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction Bankrate

The Home Mortgage Interest Deduction Lendingtree

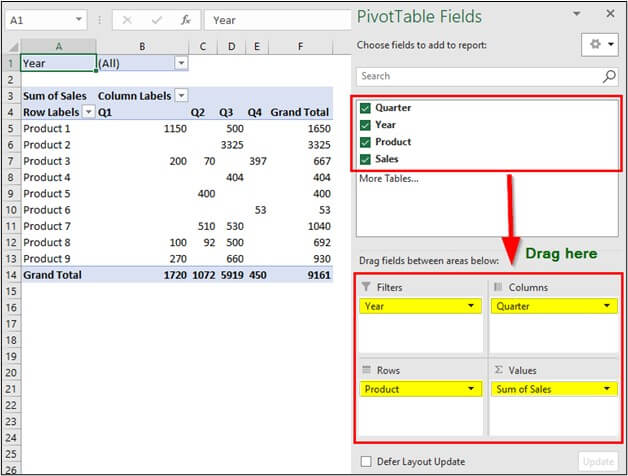

Pivot Table In Excel Examples How To Create Pivot Table

Mortgage Interest Deduction Bankrate

Fine Properties Winter 2022 By C Ville Weekly Issuu

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

What Every Divorce Attorney Needs To Know About Their Client S Form 1040

4733 Hunting Country Rd Tryon Nc 28782 Realtor Com

Mortgage Interest Deduction Bankrate

Calculating The Home Mortgage Interest Deduction Hmid

Riverdale Press Real Estate April 23 2015 By Riverdale Press Issuu

Making Sense Of Irs Form 1098 What You Need To Know Tms Tms Grow Happiness

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid